Creating a Payment

Create a new payment in the system.

Access Endpoint URL:https://rest.everyware.com/api/Default/CreatePayment [POST]

The CreatePayment method allows you to accept online credit card or bank account payments.

Inbound Parameters

Parameters should be passed in a single JSON-body object.

Parameter Name | Description | Optional/Required |

|---|---|---|

FirstName | The first name of the customer making the payment. | Required |

LastName | The last name of the customer making the payment. | Required |

Address1 | Line one of the address of the customer making the payment. May not always be required depending on the gateway. | Optional |

Address2 | Line two of the address of the customer making the payment. | Optional |

City | The city in the address of the customer making the payment. | Optional |

StateCode | The state code in the address of the customer making the payment. Format: 2-letter code (TX, FL, etc.) |

|

PostalCode | The postal/zip code in the address of the customer making the payment. | Optional |

CountryCode | The country code in the address of the customer making the payment. Example: United States = US | Optional |

The email address of the customer making the payment. Format: [email protected] | Required | |

MobilePhone | The mobile phone number (10-digits max, no formatting) of the customer making the payment. If Everyware messaging and invoicing are not being used, a unique 10-digit number that is not a phone number may be used. Speak with your Everyware representative for more information. Example: 3055551212 | Required |

CCNumber | The credit card number of the customer making the payment. No spaces should be included in the parameter. | 💳 REQUIRED FOR CREDIT CARD METHOD |

ExpirationMonth | The month in which the paying customer's credit card will expire. Months 1-9 require a preceding 0. Examples: "05", "11" | 💳 REQUIRED FOR CREDIT CARD METHOD |

ExpirationYear | The year in which the paying customer's credit card will expire. Must be provided in 2-digit format. Example: 2016 = "16" | 💳 REQUIRED FOR CREDIT CARD METHOD |

CVV | The verification code on the paying customer's credit card. For Visa or Master Card, this is a 3-digit number. For American Express, this is a 4-digit number. | 💳 REQUIRED FOR CREDIT CARD METHOD |

CardType | The brand of the card. | Optional |

CardToken | The token for the card to be charged, as returned from the Create Payment API. | Optional |

ACHToken | The token generated from the individual's banking information. | Optional |

AccountName | The name associated with the bank account. | Optional |

AccountNumber | The bank account number of the customer. Used for ACH transactions. When testing in the sandbox, any account number between four and eleven digits may be used. | 🏦 REQUIRED FOR ACH METHOD |

RoutingNumber | The bank routing number for the customer's bank account. Used for ACH transactions. When testing in the sandbox, any valid US routing number may be used. | 🏦 REQUIRED FOR ACH METHOD |

AccountType | The type of bank account. | Optional |

PaymentType | Default value set to "CreditCard". If doing ACH transactions, set value to "ACH". | Optional |

Amount | The amount that is to be paid by the customer. Example: 1.00 | Required |

Description | A description of the processed order. | Optional |

OrderNumber | This should be a unique value your application defines which is associated with the invoice that appears on the top of the customer facing invoice as "Invoice #" and throughout the Everyware portal. | Optional |

ChargeType | Charge – Charge a Credit Card or ACH account in a single transaction. For ACH 🏦 - Use Charge Authorize – authorize a Credit Card for a specific amount but doesn't charge it right away. Default value is Charge. Use this parameter instead of IsAuthOnly unless your Everyware Implementation Specialist indicates otherwise. | Optional |

IsEmailReceipt | True/False. If true, sends a receipt via automatic email to the email address provided above. Default value set to true. | Optional |

IsSMSReceipt | True/False. If true, sends a receipt via SMS to the mobile phone number provided above. Default value set to true. | Optional |

CreateToken | True/False. Set to true to tokenize credit card or ACH account as it is run. Set to false if tokenization is not desired. Default value set to false. | Optional |

StatementDescriptor | In payment receipts and receipt text messages, the statement descriptor is what will show on the customer's bank statement. Note: *Make sure this matches with what will actually show on your customer's bank statement to avoid confusion. Otherwise, set up custom descriptors for your sales site(s) with your Everyware rep. | Optional |

IndividualID | The ID associated with the customer making the payment in the Everyware system. | Optional |

ExternalID | A unique identifier from an external system associated with the payment that Everyware can store. | Optional |

IsAuthOnly | True/False Determines whether this is simply authorization and not capture. Used only for specific gateways. Default value is set to false. | Optional |

ConvAmount | The dollar amount for an optional convenience fee. The settings for this fee can be adjusted in Portal. If left blank or at $0.00, it will not appear as a line item. | Optional |

TipAmount | The dollar amount that will be left as a tip. | Optional |

TaxAmount | The dollar amount for the taxes to be charged. Settings for taxes can be adjusted in Portal. If left blank or at $0.00, it will not appear as a line item. | Optional |

SubtotalAmount | The total dollar amount for all line items excluding taxes and fees. | Optional |

DiscountAmount | The amount that will be discounted from the total charge. | Optional |

DeliveryFee | The dollar amount for the optional "Delivery Fee" line item, which can be activated and adjusted in Portal. If left blank or at $0.00, it will not appear as a line item. | Optional |

CustomFee1 | The dollar amount for an optional, custom line item. This fee type can be activated, labeled, and adjusted in the Everyware Portal. If left blank or at $0.00, it will not appear as a line item. | Optional |

CustomFee2 | The dollar amount for an optional, custom line item. This fee type can be activated, labeled, and adjusted in the Everyware Portal. If left blank or at $0.00, it will not appear as a line item. | Optional |

CustomerExternalID | A unique identifier from an external system associated with the customer making the payment that Everyware can store. | Optional |

InvoiceExternalID | A unique identifier from an external system associated with the invoice the customer is paying that Everyware can store. | Optional |

OtherAmount1 | A field that can store any other amount associated with the payment that is desired. | Optional |

OtherAmount2 | A field that can store any other amount associated with the payment that is desired. | Optional |

OtherAmount3 | A field that can store any other amount associated with the payment that is desired. | Optional |

OtherAmount4 | A field that can store any other amount associated with the payment that is desired. | Optional |

AmountPaymentFee | The fee associated with special charges for certain payment methods. If you charge 1.00 to use a card, for example, this is where you would indicate the 1.00. | Optional |

OtherAmount1Name | The name for the amount in OtherAmount1. | Optional |

OtherAmount2Name | The name for the amount in OtherAmount2. | Optional |

OtherAmount3Name | The name for the amount in OtherAmount3. | Optional |

OtherAmount4Name | The name for the amount in OtherAmount4. | Optional |

NamePaymentFee | The name given to the amount in the AmountPaymentFee parameter. | Optional |

Sample Use Case 1: Create Card Payment

Use a customer's card as the payment method.

{

"FirstName": "Suzie",

"LastName": "Sick",

"Address1": "123 Testing",

"Address2": "",

"City": "Austin",

"StateCode": "TX",

"PostalCode": "78701",

"CountryCode": "US",

"Email": "[email protected]",

"MobilePhone":"5125555555",

"CCNumber": "111111111111111",

"ExpirationMonth": "11",

"ExpirationYear": "29",

"CVV": "111",

"Amount": "1",

"Description": "New Patient Enrollment Fee",

"OrderNumber": "111111",

"ChargeType": "Charge",

"IsEmailReceipt": false,

"IsSMSReceipt": true,

"StatementDescriptor": "HelloSunshine",

"CreateToken": true

}curl --location 'https://rest.everyware.com/api/Default/CreatePayment' \

--header 'Authorization: Basic [xxx]' \

--header 'Content-Type: application/json' \

--data-raw ' {

"FirstName": "Suzie",

"LastName": "Sick",

"Address1": "123 Testing",

"Address2": "",

"City": "Austin",

"StateCode": "TX",

"PostalCode": "78701",

"CountryCode": "US",

"Email": "[email protected]",

"MobilePhone":"5125555555",

"CCNumber": "111111111111111",

"ExpirationMonth": "11",

"ExpirationYear": "29",

"CVV": "111",

"Amount": "1",

"Description": "New Patient Enrollment Fee",

"OrderNumber": "111111",

"ChargeType": "Charge",

"IsEmailReceipt": false,

"IsSMSReceipt": true,

"StatementDescriptor": "HelloSunshine",

"CreateToken": true

}{

"IsSuccess": true,

"Message": "The credit card has been accepted.",

"Data": {

"TransactionStatus": true,

"InvoiceNumber": "ew_3JN25fAawEMtODxF3OEtn7Q1",

"InvoiceID": "ew_3JN25fAawEMtODxF3OEtn7Q1",

"TokenStatus": true,

"TokenResult": "card_ew12345678abc"

},

"OrderNumber": "111111"

}Sample Use Case 2: Create Bank Account Payment

Use a customer's bank account as the payment method.

{

"FirstName": "Suzie",

"LastName": "Sick",

"Address1": "123 Suzie St",

"Address2": "",

"City": "Boca",

"StateCode": "FL",

"PostalCode": "33472",

"CountryCode": "US",

"PaymentType": "ACH",

"Email": "[email protected]",

"MobilePhone": "5129474078",

"AccountNumber": "1234536",

"RoutingNumber": "031176110",

"Amount": "1",

"Description": "Name of Item Purchased",

"ChargeType": "charge",

"IsEmailReceipt": false,

"IsSMSReceipt": true,

"StatementDescriptor": "HelloSunshineMaster",

"CreateToken": false

}curl --location 'https://rest.everyware.com/api/Default/CreatePayment' \

--header 'Authorization: Basic [xxx]' \

--header 'Content-Type: application/json' \

--data-raw ' {

"FirstName": "Suzie",

"LastName": "Sick",

"Address1": "123 Suzie St",

"Address2": "",

"City": "Boca",

"StateCode": "FL",

"PostalCode": "33472",

"CountryCode": "US",

"Email": "[email protected]",

"MobilePhone": "5129474078",

"AccountNumber": "1234536",

"RoutingNumber": "031176110",

"Amount": "1",

"Description": "Name of Item Purchased",

"ChargeType": "charge",

"IsEmailReceipt": false,

"IsSMSReceipt": true,

"StatementDescriptor": "HelloSunshineMaster",

"CreateToken": false

}{

"IsSuccess": true,

"Message": "\r\nThe credit card has been accepted.",

"Data": {

"TransactionStatus": true,

"InvoiceNumber": "EWTest_141150e7-1cae-4236-be7a-6147098614fa",

"InvoiceID": "EWTest_141150e7-1cae-4236-be7a-6147098614fa",

"ReceiptNumber": "EWTest_141150e7-1cae-4236-be7a-6147098614fa",

"TokenStatus": false,

"TokenResult": null

},

"OrderNumber": "E366849224",

"SMSID": null

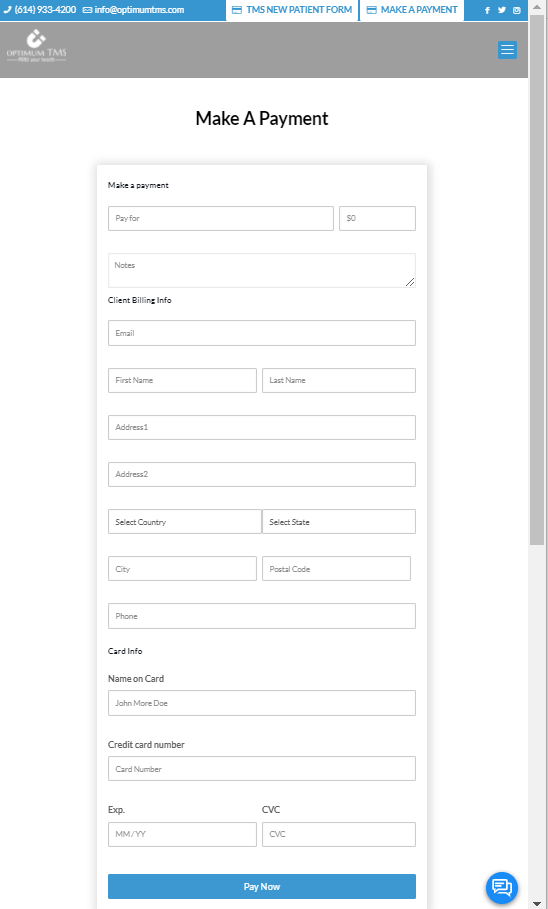

}Example Integrated Payment Webform

Integrated payment webform using the CreatePayment API to process online card payments.

Updated 11 months ago